Andrew Furey and Siobhan Coady have not been the worst combination of Premier and finance minister Newfoundland and Labrador has ever had but they are in the top five, easy. Since Confederation, there have been some very good pairs looking after the public purse but over the past 20 years simply we have seen over and over what the world will in future called Trumpian levels of fiscal and economic blindness of the sort that is now normal in Newfoundland and Labrador. We got Trump-beta - the test version - in 2003 and since then we’ve been leading the western world’s downward political competency spiral.

The Peter Pan and Wendy of Neverland finances will deliver their last tag-team budget this afternoon even though Furey’s a dead duck Premier and at least one of his likely successors has a very different agenda than Furey’s handpicked replacement. whatever comes has nothing to do with Donald Trump or a cocern for hindering Furey’s successor, or any of the other excuses you’ll see from politicians pundits alike.

No.

Convention would delay the budget until after the Liberals sort out their leadership but those sorts of things mean nothing to transformational leaders like Andrew Furey, especially when the guy most likely to win is the avatar carefully chosen to replace the avatar Furey doesn’t have a clue what he might do himself. He’s just the captain for show and his job will be to show up, look pretty, and recite prepared lines.

Nor will what’s coming in the budget have anything to do with Donald Trump for that matter, whose crackpot financial ideas rival only those of a Canadian Premier who flew to Europe and told people that diversifying our ever-increasing public debt was a good thing.

Whatever the Lost Boys and Girls do this week, let us keep our own feet firmly on the ground with a reminder of the strategic trends.

We’ll do another Subscriber Livestream on the Substack App at 7:00 PM Newfoundland and Labrador Daylight Savings Time this evening. Paying Subscribers only so if you want to get in on that discussion and all the other subscriber-only features click the button below.

Reality is all about trends.

The trends we are going to talk about are oil prices, oil production, and government spending.

Oil prices and oil production are important because they tell the tale of how the past couple of decades took a provincial government with excellent trends over the long-term and great prospects and wrecked everything. The first crowd - Danny’s bunch - boosted spending based on unreliable, unpredictable oil money. Every crowd since, starting with Danny’s hand-picked successor kept spending more and more, without a noticeable break. When there was less oil money, they borrowed more.

Let’s start our story with oil prices.

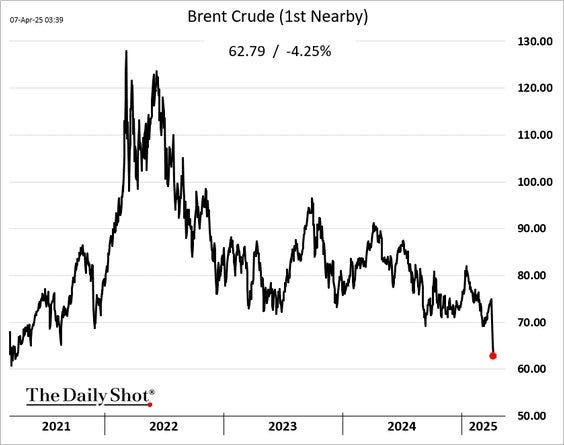

Newfoundland and Labrador’s oil sells for Brent crude prices. We all say that crude prices change a lot but to see how much it changes just look at this chart at the top of the column, which only covers really the whole time Andrew Furey has been Premier.

Just glancing at the chart you can see that most of the time, oil has been below US$90 a barrel. This week, it is trading about one third less than that and if you look at the whole chart, Newfoundland and Labrador oil is currently worth about half of what it was going for during a very brief period in 2022. If you look at the chart from 2022 onwards you can see that - regardless of the annual average - the general trend in oil prices for Newfoundland and Labrador crude is downward. The dramatic fall since just last week just adds to the overall trend.

This chart gives Brent prices over a long period. You can see here that before 2022, Brent traded for scarcely more than US$80 a barrel. All through that time, provincial governments in Newfoundland and Labrador didn’t change spending. They just kept it up and even ramped it up.

Goldman Sachs this week forecast Brent would sit somewhere around US$60 a barrel by year’s end and around US$50 by December 2026. In a worst case scenario forecast by GS, oil would be about US$50 by year’s end and US%45 by the end of 2026. Morgan Stanbley is slightly more optimistic, with a forecast of Brent at US$60 at the end of the year while Citibank’s short term forecast for crude is around where it is now, at US$60 a barrel.

That’s oil prices. Watch closely the forecast for oil prices in the budget. The more optimistic the number, the more you know they are trying to make it look like borrowing will be lower than likely.

Now let’s look at oil production offshore Newfoundland and Labrador.

Oil production in Newfoundland and Labrador is dropping. Not a surprise. Even with Hebron (that grey bit), total oil production offshore is dropping. Terra Nova is on its last legs and attention is already turning in official circles on a close-out plan for that field. The others are not quite there yet but White Rose and its associated fields will draw down as will Hebron. Hibernia has maybe 20 to 25 years left in it. The OF - original field - will keep chugging when the others are dead.

Even with Bay du Nord, we can easily forecast the end of most offshore oil production and because of the drop in production, oil revenue will go drown right on cue. Bay du Nord may affect that timeline for the End of Oil but as oil prices plummet, BDN may become non-viable in the long run. A Trump-inspired recession may delay the project for two to three years or more. The operators will make a decision on that field based on long-term trends in prices, not a temporary hit. That’s what will tell. The long-term trend. right now, that long-term trend is uncertain.

As it is, the BDN operators are looking to lower start-up costs as much as possible. So even if it gets a greenlight within the next couple of years, that means no local fabrication beyond small stuff. The operators also want a rented, floating platform, coming off a South Korean line as a generic hull that would be customized somewhere else. To the extent possible, the operators might also want minimal crew onboard with operations controlled from a shore station.

There are a couple of things to unpack from that. In the short term, that BDN situation poses both a political and a financial choice for Newfoundland and Labrador. Financially, lower costs on start-up maximise the revenue stream to the provincial government since the project would stand a better chance of hitting pay-out early. That has a political downside where both the government and key industry players locally are mired in 40 year old ideas about what’s good and that usually is all about trading off government revenue for short-term local jobs.

In the longer term, if there is to be continued oil production offshore and new oil and gas production offshore, the future will likely look more like this BDN idea by main operator Equinor than anything in the past. Very people on a platform lowers costs but it also lowers the safety risks. The Newfoundland and Labrador offshore has a stellar safety record but reduced crews offshore will lower the risk of a major incident. And this lower employment means that oil will become even more capital intensive versus labour intensive. We’ll need to update our thinking. Heck, that’s long overdue anyway.

But let’s save that discussion for another time.

What we need to focus on here is that even with Bay du Nord, production offshore will decline over time as some of the existing fields dry up. Pierre Poilievre’s promise to double oil production offshore is like the Team Ball/Team Furey pledge he was repeating. Just not sensible. To make the promise real, we’d need to see huge changes in exploration, even more unlikely increases in commercial discoveries, and a continued global demand backed by high prices that frankly aren’t there now and likely won’t be.

The Liberal plan to double offshore production by 2030 called for ridiculous performance the offshore has never come close to meeting and never will. So let’s just lay that aside and recall that the two big trends are oil production down and prices down. Even if prices tick up, production drops will mean less government money from oil either directly through royalties or indirectly through local jobs, taxes, and spending.

Now let’s do the fun bit: government spending.

The picture shows that every year since 2012, the provincial government has turned in a cash deficit. Every year. Even in the one blank bit which was officially a surplus, it was actually a deficit. The surplus was an accounting thing. Andrew Furey and Siobhan Coady have followed the trend that actually goes back to 2006 of spending more and more and covering covering off the gap between spending and the government’s own revenue with a combination of borrowing and federal transfer payments. Rather than change spending, Andrew Furey and Dwight Ball have been chasing after more federal handouts, like Equalization. They even stole money from the federal government’s interest in Hibernia that was supposed to go to lower the cost of Muskrat Falls for consumers and instead ploughed it into more spending.

The image is from last year’s budget column. The 2024 figure was the projected deficit of about $2.0 billion. By the end of the calendar year, that number was now $2.8 billion, which would make it more than the 2015 one, which is that big finger you see sticking down more than the others. You can see at a glance that most of the deficits are more than $1.5 billion annually. Since 2015, there have only been three years when the cash deficit was below $1.5 billion. Two of those were still north of $1.0 billion.

Since 2015, in an effort to hide what is going on, the government has also adjusted the way it reports public spending. One of the big ones was to adjust the way government reportged debt servicing costs. They did it after several years of reports by your humble e-scribbler that used debt servicing as a share of revenue as one indicator of government’s unhealthy finances. Not a coincidence.

The guv’mint crowd made major changes in 2024 - the year of record spending, record health spending, and near record deficits - by burying some reports and schedules and disappearing others. This year, it looks like they will do away all together with the annual cash-based estimates. Instead, we’ll only see accrual accounting, which has been showing us over the past decade the miracle of record borrowing to pay bills (all new debt, in other words) while at the same time reporting astonishingly low official deficits. It’s an incredibly misleading way to report the government’s spending and without cash accounting it’s harder to compare spending over time.

Don’t be surprised if this year we see typical hefty borrowing coupled with the claim there’s a balanced budget even though the budget isn’t balanced. Equally don’t be surprised if we see huge borrowing, a claim of a relatively small deficit, with blame for the continued deficit on Donald Trump. It won’t be that. A higher deficit will pay for all the election promises in the actual election year (as opposed to last year’s election budget for an election Furey balked at calling) as well as more subsidies to cushion people against whatever impact Trump’s tariffs will have.

To really understand the strategic position the government is in and will not change, let’s drill a bit deeper and look at last year’s budget

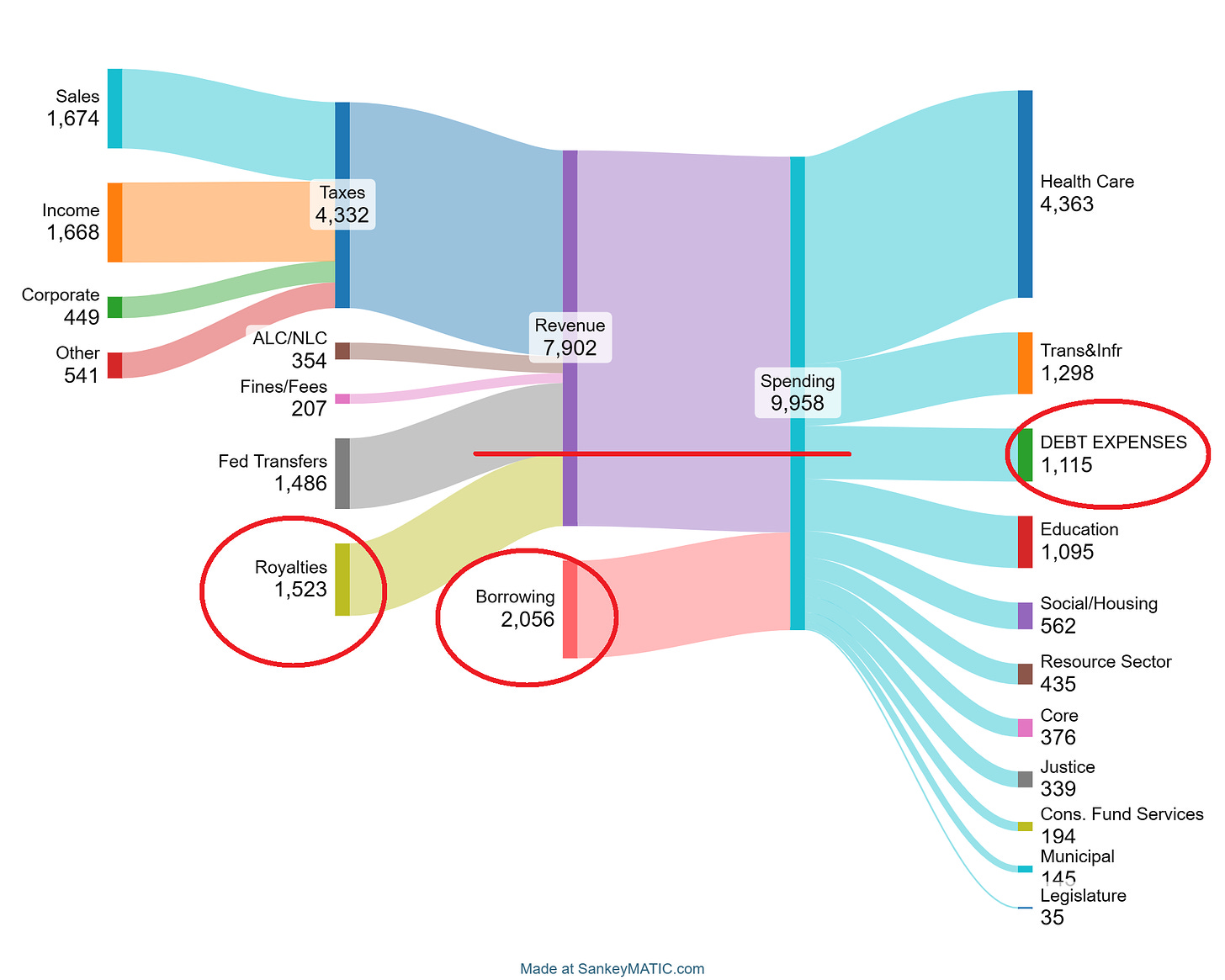

This is a great Sankey chart of last year’s budget. The ring’s come from the original post online by Eugene Manning, the guy who generated the Sankey chart.

The government planned to spend about $10 billion last year. It expected to bring in a bit less than $8 billion of its own. That means the largest source of government income in 2024 has been borrowing. Of government’s other income, oil royalties, income tax, sales tax, and federal transfers were all roughly around $1.5 billion each.

The budget planned to take all the government’s tax income - around $4.3 billion - and use that to pay for health care. Everything else - justice, education, roads, and so on - came from three sources that the government has no control over: federal handouts, oil royalties, and borrowing. About a half billion from fines and liquor corporation (effectively another tax) made up a small addition amount to over off those non-health bills.

Incidentally, one of the reasons why the government won’t give up liquor stores is that $350 million it makes annually. Even though they could get more by chucking the whole thing to the private sector and cleaning up the massive conflict of interest at NLC, it’s politically easier to stay on course than to change, especially with a powerful union and a powerful bureaucracy that, like Margaret Thatcher, isn’t for turning. This is a deeply conservative province with lots of reactionaries, especially ones running unions.

We started off talking about the big strategic weakness for Newfoundland and Labrador of oil, the government’s chronic dependence on it, and the knock-on consequences of not adjusting spending to match income but instead using new debt to fill in the hole. When we dig into chronic overspending, which is another big and chronic strategic weakness for Newfoundland and Labrador after 2003, we see how the oil dependence *increases* the impact of the overspending problem.

What we’ve seen in the past 12 months and this is Andrew Furey’s unique contribution to destabilizing the province’s finances strategically, is the massive increase in health spending. That now leaves us with the government’s own income from taxation sources funding health care> every other service is basically dependent on three sources of income government cannot control in any meaningful way.

Here’s the killer: before 2003 and in the 1970s and 1980s in particular, the provincial government had a chronic strategic problem in which half its income came from sources it didn’t control. Both the Pea Seas and Liberals supported getting off Equalization and using oil royalties to change that situation fundamentally. They also worked hard to diversify the economy and create an environment for the private sector to drive future economic growth. That disappeared in the early 2000s. Since 2003, successive government’s have basically put us back in exactly that same predicament again.

But it gets worse.

What killed self-government in Newfoundland in 1933 was that the cost of servicing debt grew exponentially to the point where it was the largest single government expense by far. The problem with debt servicing is that it was not and is not a discretionary expense. The government had to pay it. Not paying produced or would have produced worse results. Well, today that role of an all-consuming fixed expense in our strategic fiasco is being played by health care.

Health care is really a discretionary expense. We can change how much we spend on health care and what we buy with our money. In practical terms, health care is a fixed expense. You’ve got to pay it and you can only pay more, not less or even the same. That’s the result of public expectations shaped by the way politicians like to pander and avoid any serious public discussion. A lack of public discourse gets you re-elected bu the price for the whole society is hideous.

On top of that health is a fiefdom owned by a legion of over-paid, under-performing bureaucrats and another legion of unionised workers who will tolerate nothing but the status quo. The result is an endless push to spend more and more, regardless of the bureaucratic and unionized workers’ collective failure over a very long time to improve health outcomes, full stop. We don’t score better on any meaningful health indicators - except per capita spending - and Andrew Furey’s Health Accord does *nothing* to change that trend. Nothing. In fact, with its massive increase in spending, the Accord makes the provincial government’s chronic, unaddressed strategic financial problems far worse, which means that at some point, the whole system will crash.

Now put that in the context of a looming trade war, economic uncertainty, and you have a nice little message to write on your note to Andrew Furey as he leaves and thank him for it. After all, in just the past decade, we’ve had two of the three major financial crises of Newfoundland and Labrador since the existential one in 1934 in the past decade. What Andrew Furey is leaving behind is the foundation for the next one, which may come much sooner than expected. Maybe that’s why he’s been so hysterical the past six months over Donald Trump and why he is running for the exit rather than delivering any of that transformative *positive* change he used to talk about.

Show Andy how much you love him

Donald Trump is giving himself a military parade but here in the former People’s Democratic Republic of Dannystan, the folks behind the celbritocracy that is our Premier want you to do something much more personal.

Peter Pan Principle: Everything either pans out or peters out. Worry does not change this.