Andrew Furey got to be Premier without a clue about what to do with the job.

No plan.

No goal.

Furey's leaving in a couple of weeks having succeeded spectacularly at nothing except making things in Newfoundland and Labrador worse. Furey can go back to life without a tie, something he boasted he'd never owned before becoming Premier.

There is shallow.

There is superficial.

There is vapid.

There is Katie Perry and a bunch of other women pretending they’re astronauts because Jeff Bezos fronted them the obscenely huge cost of a ride in his amusement park ride.

Then there is the kind of person who talks about whether or not he’d owned a tie before 2020 in answer to a question about his time in the most important and potentially consequential political job in Newfoundland and Labrador.

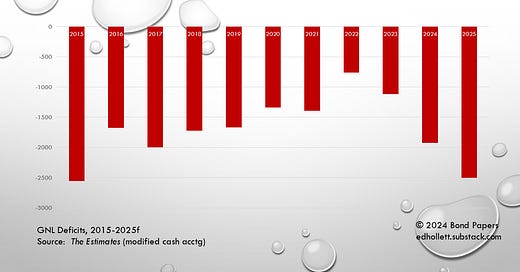

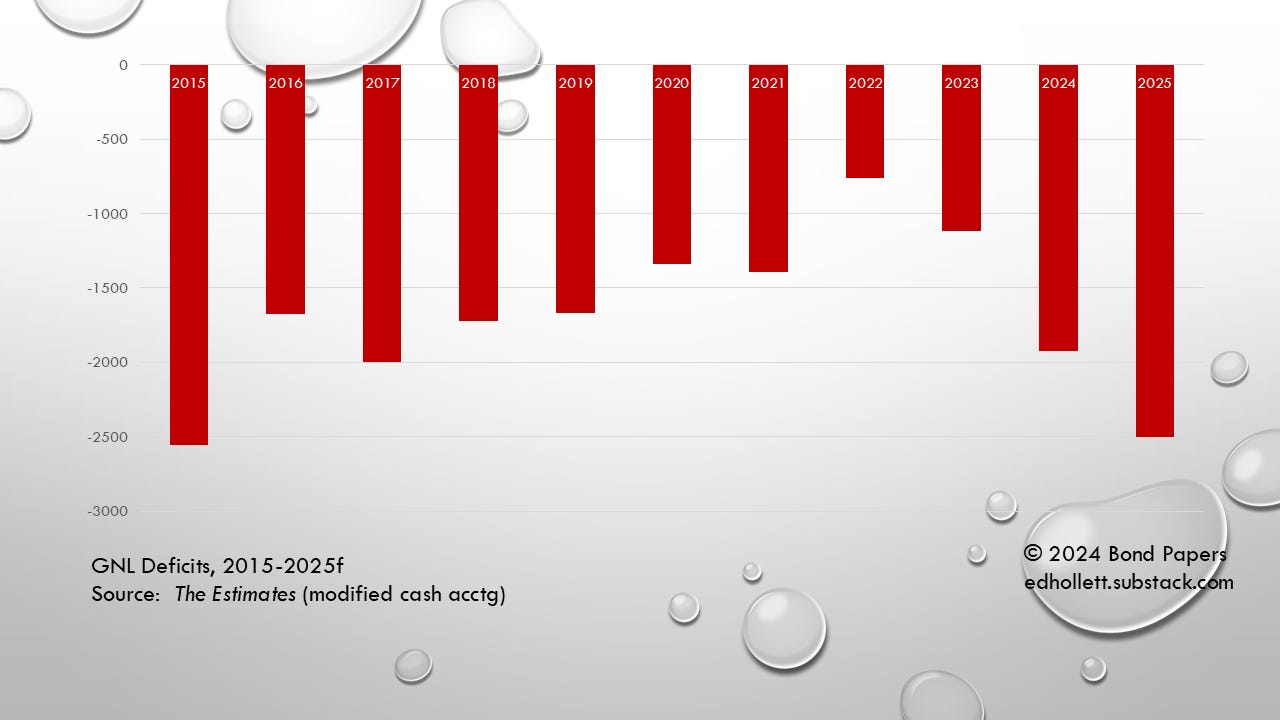

Andrew Furey cost each of us, in total, $7.7 billion during his time as Premier. That’s the sum of the deficits in every budget his administration put before the House of Assembly, which then approved without hesitation. There are no credits to counterbalance those debits.

If we included Furey’s unconscionably bad deal with Quebec as well as the offshore giveaway to Ottawa in the tally, he’d beat Danny Williams by a considerable distance as the undisputed king when it comes to having such an appalling badly impact on the province financially. Williams racked up enormous deficits through overspending - although he was an amateur compared to Furey - and his legacy deal cost taxpayers $15 billion if we only count the book value. Churchill 2 is way worse than Muskrat, plus Furey also didn’t fix Muskrat. If we added in what the people of Newfoundland and Labrador will actually pay over the 50 years or so of the deal, Williams still couldn’t match Furey’s fiascos.

Dwight Ball is an amateur, by comparison, in third place, with $8.4 billion in accumulated deficits and no credits to balance it off or super-bad deals to fatten the debit pile.

Become a paying subscriber.

The three most appallingly bad administrators of the government in Newfoundland and Labrador since 1949 have all held office since 2003 and Andrew Furey is the worst so far.

This isn’t an accident.

Nor is it the simple function of inflation.

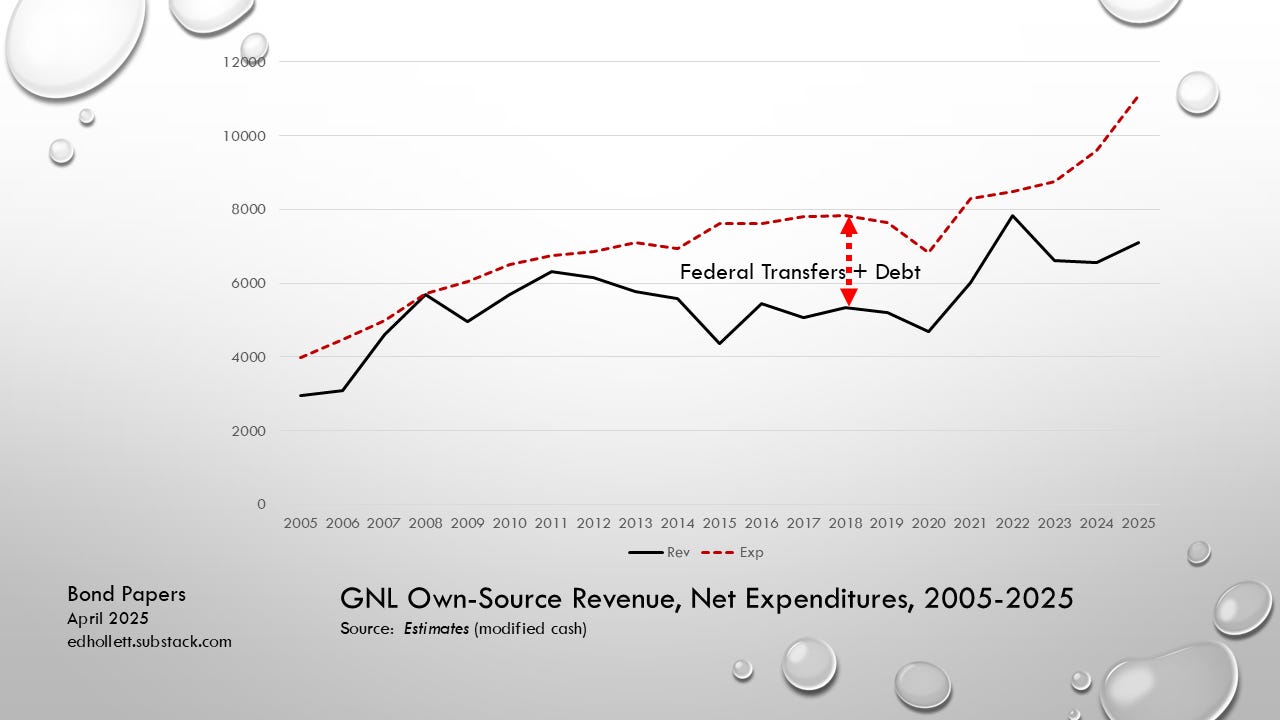

Governments from Danny Williams onward have spent as much money as they could, and more besides. They filled in the gaps between the government’s income and the amount spent with a combination of federal handouts, money from selling off oil assets (and with no savings of it at all), and increasingly, debt.

To be fair, in some years this did actually turn up a surplus but since 2011, there’s been nothing but new debt. But also to be honest, the past decade has been the worst of all for piling on new debt. As you can see from the chart below, the amount of new debt has been getting worse under Andrew Furey.

Total public liabilities in 2005 was around $12 billion. That’s everything the government owed on your behalf. Adjusted for inflation, that would be roughly $18 billion today. The most recent budget put the actual figure for total public liabilities today at roughly $36 billion.

In 2005, the government’s total income was $2.953 billion of its own money and $1.675 billion in federal transfers. In 2025, the budget predicts the government’s income will be a shade over $7.0 billion, including Hibernia money transferred from Ottawa and around $1.5 billion in other federal transfers.

The difference is in spending. In 2005, the government actually turned in a small surplus, about $500 million with total spending of around $4.0 billion.

In 2025, the budget calls for spending of more than $11 billion with a deficit of about $2.5 billion and total borrowing of $4.1 billion. The government will spend more money on health care alone in 2025 than it spent in total two decades ago but will get no better care for citizens as a result.

Trevor Tombe is an Alberta economist who developed new indicators of provincial government financial health. We started writing about them here in 2019. One of the more striking ones is the amount of money government spends that comes from borrowing and non-renewable resources (oil and mining) Right now about one third of annual government spending comes from those two externally controlled and unreliable sources. They are unreliable because we cannot accurately predict their value - in the case of oil - or cost and availability, in the case of new debt.

For most of the past 20 years, the provincial government’s financial vulnerability index - deficit plus non-renewable resource revenue as a share of spending - has been at or above 33%. No coincidence that within the past decade, we’ve seen the government have problems making payroll, as the saying goes, in largest part because of the government’s dependence on borrowing.

Another way to look at the government’s financial problem is how much it spends each year beyond income. That’s the chart shown above. It’s deficit as a share of government income from all sources (taxes, oil, federal transfers etc). It shows how clearly the new public debt added by Dwight Ball and Andrew Furey is deliberate and not connected in any way to spending a set amount of money per person either by choice or because that amount is needed to provide core services. This is just chronic overspending. Government income in 2019 was slightly under $6.0 billion. In 2024, the provincial government brought in $1.7 billion more and yet still ran a deficit that was 25% larger than its income. The 2025 budget calls for income slightly below the outlier year of 2021 but the forecast deficit is 30% higher.

In the new television series Your Neighbours & Friends, John Hamm plays a hedge fund manager who resorts to burglary after losing his job. He steals from his friends and neighbours. That’s what this all new debt is: stealing. Stealing from friends and neighbours. Stealing from ourselves. And since this debt never does away, it is stealing from future generations.

There are two obvious problems with this new debt. First, the amount needed each year just to pay the interest on the new debt grows steadily. It is the third largest expense the government has after health care and education. The amount the government spends on debt servicing is so embarrassing for any Canadian government, the Newfoundland and Labrador government changed how it reported the budget numbers, in part to hide the prominent place paying the interest on the ever-growing debt takes up.

Second, we have to find new debt every year, including in years like this one where the government has to borrow even more just to roll over debt from years before that’s come due. This year the new debt will likely add up to about $3.0 billion, not the $2.5 billion forecast in the budget. On top of that’s the government must refinance another $1.5 billion in old debt.

We aren’t always lucky enough to find that much new debt. In 2015 and again in 2020, the provincial government couldn’t get money at a price it was prepared to pay. With a looming international recession and massive changes in global trade, Newfoundland and Labrador is planning to mount one of its heaviest borrowing programs since Confederation. That is beyond risky to be more like foolhardy.

That borrowing all comes with the risk that the government will pay significantly higher debt servicing costs in future or we may see a repeat of 2015 or 2020. The federal government has some room to help out but only by adding significant new debt itself and there will be a limit to how much the federal government can help and for how long. In a sense, that expectation the federal government should bail out a provincial government that does nothing to fix its own problems is another theft from our friends and neighbours.

Just to be clear, this belief that thievery is not just acceptable but is a fine way to run a supposedly responsible, democratic government is not just Liberals’ fault and not just politicians’ fault.

Everyone in the province is in on this grift, which is really why it will only stop as it did in the 1930s when no one outside Newfoundland and Labrador would put up with it any more. That sort of day may not be too far in the future.

Out of curiosity ... the GNL is issuing debt; but how much does it spend on investment (say in infrstructure), as opposed to subsidies and operating expenses?

The Bondholders of our debt will have to step in and solve this problem for us, hopefully.

Maybe this is why the politicians are out spending like drunken sailors. New schools all over the place. $10 Million for restaurants. Next thing will be pavement in to everyone's toilet. $30 Billion or $35 Billion or $40 Billion - whats the difference? The numbers are so mind boggling that no one can relate.