Understanding the reality of the CF MOU

by Mike Wilson

Editor’s note:

In his latest commentary, Mike Wilson tackles five topics:

The Board of Newfoundland and Labrador Hydro has not fulfilled a key fiduciary responsibility.

The fundamental structure of the MOU is seriously flawed.

The anticipated benefits of the MOU are neither balanced nor fairly stated.

Inflation and the time value of money have not been considered [by NLH].

Not all information provided to the public [by NLH] is accurate and complete.

We’ve given it a light edit for style.

In the original email, Mike had other documents that expand on each of the five. Rather than post them all in one huge document, we’ve broken them up as their own commentaries. As we publish the others, we’ll add links in the appropriate spot in this commentary. The first one is already published so the link is there.

Stay informed.

1. The Board of NLH has not fulfilled a key fiduciary responsibility.

The Transparency and Accountability Act is a law requiring Crown corporations to ensure public understanding of its financial results, plans, actions and commitments.

Transparency requires an openness in providing the public with access to information supporting decisions and sharing what can be shared openly and honestly.

Accountability is the obligation of officials to justify their decisions and take responsibility for outcomes. These principles are fundamental to good governance and to ensure the corporation is answerable to the public. Fully informed citizens can belter participate in discussions about the MOU and suggest changes where desired.

The Board has a fiduciary responsibility to ensure all information provided to the public, including all representations of the NLH President and Chief Executive Officer Jennifer Williams are accurate and complete. Given the volume of inaccurate and incomplete information provided to date, the public is confused and lacks a sufficient understanding of the MOU. In this regard, it is fairly obvious the Board has not fulfilled a key fiduciary responsibility to provide transparency and accountability.

Mike Wilson's War

The proposed pricing mechanism provides a lower rate of return than the 1969 contract.

2. The fundamental structure of the MOU is seriously flawed.

In my previous commentary and analysis, I pointed out the unnecessary complications and confusion arising from bundling two very different types of negotiations in a single MOU. The resultant final agreements are inextricably linked as they will all be executed on the same day.

Consequently, there is no opportunity for Churchill Falls (Labrador) Corporation or CF(L)Co to get a new Churchill Falls (CF) Power Purchase Agreement (PPA) without Hydro Quebec (HQ) obtaining a 40% interest in the proposed development of Gull Island (GI).

To avoid obvious conflict of interests, CF(L)Co, the owner of the CF facility, should have engaged independent negotiators with a mandate to maximize the price for power, from both the existing facility and the proposed upgrade and expansion, to be paid by its two customers NLH and HQ.

Likewise, the province of Newfoundland and Labrador (NL), the owner of the Churchill River (CR), should have engaged independent negotiators with a mandate to review the development proposal from the proponents NLH and HQ, consider all alternatives and ensure the province obtains the maximum economic benefit from the development of GI. In this context, the fundamental structure of the MOU is seriously flawed.

It has been recently stated in the media, the MOU is simply too complicated for the majority of people, including the media and our elected representatives, to understand. The frequent misuse and possible misunderstanding of simple terms such as cost, price and value are widespread.

In my initial commentary and analysis, I focused primarily on the pricing structures. However, due to the MOU’s complexity, the majority of people still do not understand there are two completely unrelated pricing structures in the MOU, both of which heavily favour HQ. [There is] One for the power from the existing CF plant and a second for the power from the new developments including Gull Island. The MOU must be pulled apart to understand how each of these pricing structures work and the impact of the time value of money and inflation on forecasted benefits.

As a testimony to structural flaws and complexity of the MOU, I needed to attach four Appendices in an attempt to unravel the confusion. I hope this commentary and analysis provides sufficient clarity to those who truly seek to understand the impact of the MOU on the wellbeing of the people of our province now and in the future. The details are important, and there is no room for half-truths, inconsistencies, and inaccuracies.

In this regard, the [oversight panel’s] July report could have been of tremendous help to the public. It could have ensured all the information provided to the public was accurate and complete, explained the two pricing structures in detail, and determined if the forecast benefits are balanced, supportable and fairly stated.

3. The anticipated benefits of the MOU are neither balanced nor fairly stated.

The pricing structure for CF existing power gives rise to a 55% surplus for HQ, being the difference between the forecast price of 5.9 cents present value (pv) and the current HQ replacement cost of 13 cents. The magnitude of this surplus clearly indicates HQ dominated the negotiation and weighed the balance heavily in its favour.

It is questionable if the financial benefits accruing to the Government of Newfoundland and Labrador (GNL) arising from HQ payments payable to CF(L)Co after 2041 (underpinning to 90% of the projected benefits) can reasonably be attributed to the early termination of the 1969 CF PPA.

For the power from the new developments, HQ negotiated a cost-plus pricing structure with Gull Island Joint Venture (GIJV) unrelated to the current or future value of the power, which again heavily weighs the balance in favour of HQ. GIJV does not benefit from an increase in the future value of the power. Just like 1969, it all goes to HQ.

Former Hydro-Quebec chief executive officer Michael Sabia has stated “the price paid for the power from the new developments is the lowest price possible for HQ and will provide over $200 billion of cost savings compared to existing alternatives.”

That is about $4 billion per year [over the 50 years of the new arrangement].

The total projected return for NLH related to the new developments will amount to an estimated $20.5 billion in nominal dollars or on average $410 million per year.

The MOU proposes a lower rate of return for the GIJV than the province received from the 1969 contract.

No attempt has been made by NLH to provide the present value, inflation adjusted equivalent for the “expected” $225 billion in benefits to the provincial treasury spanning a 60-year period. In addition, the full $68 billion, nominal dollars, forecast profit from the GIJV would not be available for distribution by way of dividends as a significant amount would be required to repay the principle portion of the GIJV financing of approximately $18.7 billion.

For industrial development in Labrador, there is no increase in power allocated until 2031 and the additional allocation is limited to 605 MW until 2050 -25 years hence. After 2041, NLH, being majority shareholder, should have the authority to increase its allocation of power to meet any and all anticipated demands at that time.

There is no provision in the MOU for the GIJV to pay a 15% special dividend to the province in lieu of provincial corporate tax as does CF(L)Co.

For the next 60 plus years, the bulk of economic development arising from the skyrocketing demand for power driven by Artificial Intelligence, electrification and other sources will take place on the Quebec side of the border, fueled by cheap power provided by its friendly neighbour, the province of Newfoundland and Labrador.

4. Inflation and the time value of money have not been considered.

The monetary amounts stated in the MOU and supplementary information provided by NLH are often presented in either “nominal” amounts or “present value” equivalents. Very few, if any, are adjusted for inflation.

When determining the present value (pv) of the forecast future payments set out in nominal amounts on Schedule G in the MOU, one must consider the time value of money and the impact of inflation.

The $225 billion in “expected” benefits set out in the NLH Fact Sheet, has never been stated in present value equivalent, adjusted for inflation. This is very unfortunate, confusing to the public and to a certain extent misleading.

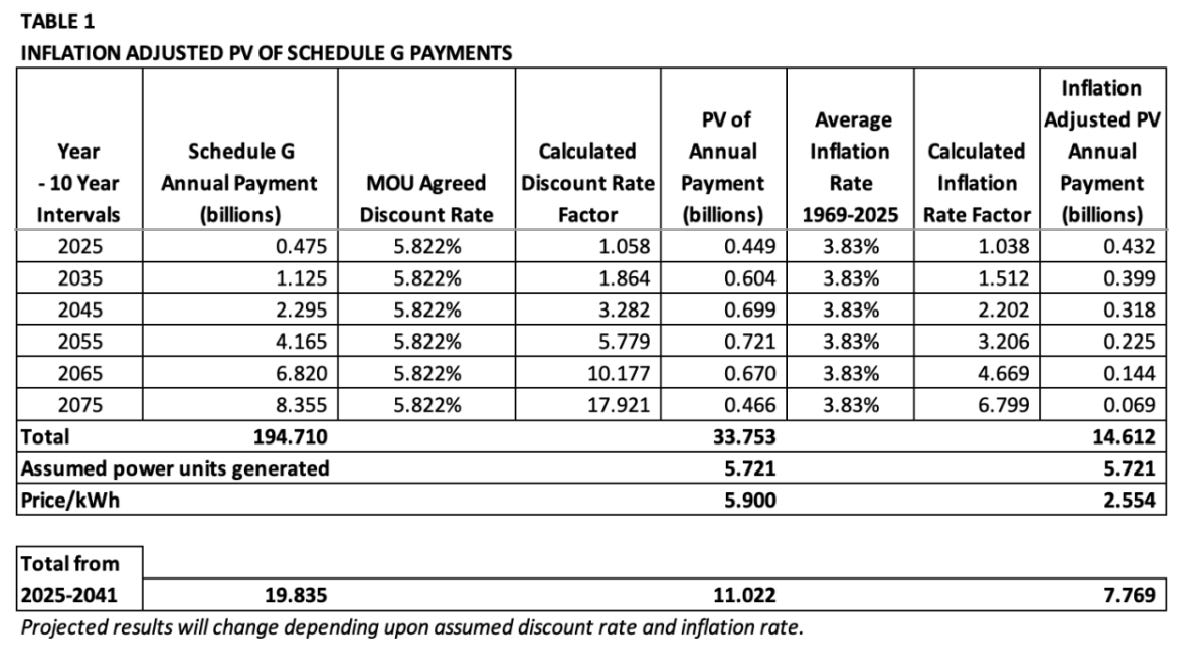

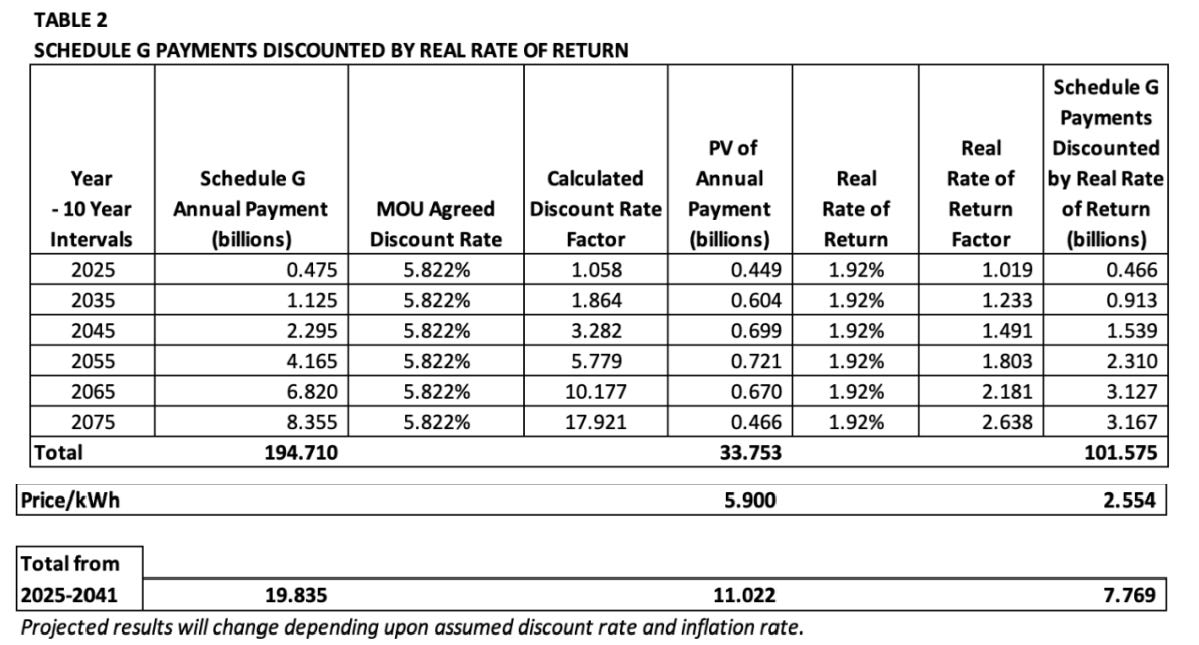

Table 1 below demonstrates how the average 5.9 cents per kWh (pv) over the term of the agreement gets ground down to 2.5 cents per kWh (pv) after adjusting for the average annual inflation rate since 1969 of 3.83%.

NLH CEO Jennifer Williams stated that “the math to arrive at 2.5 cents does not make sense at all.” Appendix C sets out the mathematical formulas to demonstrate that the math makes sense and is fully supported.

The forecast payments set out on Schedule G totaling $194.7 billion has a present value in 2025 of $33.8 billion but when adjusted for inflation is reduced to $14.6 billion.

Likewise, the $8.3 billion forecast payment in the year 2075 sounds like a huge amount of money however, when discounted and adjusted for inflation, the amount is ground down to $69 million (pv).

The Schedule G payments totaling $19.835 billion made by HQ to CF(L)Co prior to 2041 have a present value of $11.022 billion and after adjusting for inflation $7.769 billion.

CF MOU: Inflation

This is part of Mike Wilson’s new commentary on the Churchill Falls deal. It expands on the section about inflation and the change in the value of money over time.

5. Not all information provided to the public is accurate and complete.

As set out in my previous commentary and analysis, some of the information provided in the NLH Fact Sheet is inaccurate or incomplete.

The September 9, 2025, document named “The Churchill Falls MOU: Just the Facts” posted on OurChapter.ca is the latest biased commentary from NLH claiming to provide “Facts” to the public. The “information provided” contains some glaring half-truths and omissions:

an invalid claim to deliver “maximum” value,

no attempt to “present value” the $225 billion in forecast benefits,

no mention it will take “35 years” to quadruple the increase in power allocation to benefit Labrador,

HQ will “not” pay for the two largest projects; the cost overruns will “not” be

funded by HQ,

the $3.5 billion (pv) is “not” a give from HQ, it is taxpayer money arising from

the acquisition by HQ of a 40% interest in the GIJV and certain other rights and privileges,

HQ will “not” pay to develop Gull Island, the joint venture company will,

the price for the power from the new developments is based on cost and “never escalates” with market value,

Schedule G is not based upon forecast market value. It is simply a series of negotiated payments targeting the $33.8 billion.

agreed value.

Just like Nalcor in relation to Muskrat Falls, at some time in the future I suspect the management and Board of NLH will be held accountable for the volumes of inaccurate and incomplete “information provided” to the people of this province.

In my first commentary [linked above], I posed three key questions about the pricing structures set out in the MOU. The response to these questions provided by Ms. Williams during recent TV and radio interviews was also inadequate and/or incomplete.

My understanding of the substance of Ms. Williams’ response is summarized below:

Gull Island valuation

Ms. Williams indirectly acknowledged there was no independent valuation of GI provided to the Board of NLH.

The Board of NLH did not deem it necessary to obtain an independent valuation prior to approving management’s recommendation with respect to the price of the most valuable undeveloped resource in the province.

Ms. Williams’ assertion that the $4.8 billion payment from HQ is not taxpayer money is incorrect. It certainly is taxpayer money.

Price for existing power from Churchill Falls

Ms. Williams stated she did not understand the relevance of a price of 2.6 cents per kwh in 2025 as HQ still pay 0.2 cents per kwh.

[Let me explain.]

Due to inflation, the purchasing power of money deceases over time. Therefore, to maintain the same purchasing power of the initial 1969 price of 0.3 cents, approximately 2.6 cents is required in 2025.

Ms. Williams did not justify CF(L)Co selling the existing CF power at an average price of 5.9 cents (pv) which is slightly more than double the inflation adjusted 1969 price of 2.6 cents and 55% lower than HQ’s “current” replacement cost of 13 cents.

It should be noted that 2.6 cents, the inflation adjusted 1969 price for CF power, is almost identical to the inflation adjusted 5.9 cents of 2.5 cents.

Mr. Sabia was quoted as saying, “the Churchill Falls complex is strategic for Hydro Quebec allowing the utility to cover 15% of its energy needs and accounting for1/3 of its profits”. Clearly HQ need CF power now and in the future.

Ms. Williams indicated “$33.8 billion is the “value” we negotiated and we chose to take it sooner rather than later.”

As it is, Schedule G does not reflect market based or “fair” pricing in 2025 and there was no explanation provided by Ms. Williams as to how and when that may change when the pricing formula is finally agreed. It begs the question, in the absence of the pricing formula, on what basis was Schedule G negotiated?

As Schedule G, is not based upon forecast market price, it simply appears to serve no purpose other than to:

Assist GNL with short term cash flow challenges by delivering part of the negotiated “value” prior to 2041 and the remainder thereafter, and

Enable HQ to limit future price increases to its ratepayers of between 3-4%.

Price for power from the new developments

Ms. Williams did not justify why the proposed commercial terms for the GIJV provide a lower rate of return than the 1969 contract.

Ms. Williams failed to acknowledge the absence of a price escalation clause related to the future value of the power from the new developments.

Ms. Williams failed to acknowledge the PPA’s for the new developments provide a fixed rate of return of between 8-9% on NLH equity for the duration of the contracts.

In a January 2025 article in La Presse, based upon an interview with HQ’s senior negotiator, Francis Vailles states “The MOU bears a striking resemblance to the controversial 1969 contract, at least for the new electricity projects .... Hydro [Quebec] will pay cost not market and the cost, as expected, would be the lowest of any potential project in North America.”

Ms. Williams did not justify why NLH have not prepared, or at least have not published, an estimated cost per kWh for the power from the new developments but nevertheless have agreed to sell the “new” power to HQ at “cost” as defined in the new PPA’s without a link to market value now or in the future.

Mr. Sabia said “prices for a similar Hydro project built in Quebec would cost 13 cents.” This is a key indicator of the value of the power.

HQ has estimated the cost of power from the new developments to be on average 11 cents (pv) which according to HQ, “includes the recovery of the $4.8 billion incentive.”

It is reasonable to conclude that the HQ 11 cents estimate also includes the cost of transmission from Gull Island to market, and if and that when NLH provide an estimate of the cost to generate the GI power, it will be significantly less than 11 cents (pv).

With respect to the new developments, La Presse quoted a senior HQ official as saying “it’s the same deal as 1969 at the end of the day, except the cost price paid annually will start much lower and will increase at 2% per year until 2084. In today’s dollars, all the payments at cost price by HQ over 50 years, even indexed at 2%, will give the same overall sum as if HQ had chosen to make constant fixed payments as in 1969.” This gentleman is a skilled negotiator, not a politician.

It should be noted that the 2% escalation referenced above relates to the forecast increase in revenue to offset future cost increases and will not change the 8-9% fixed return on NLH equity investment in the GIJV.

Mr. Wilson’s point 4 is incorrect. Inflation is embedded in the time value of money framework, and the time value of money is already reflected in the discount rate used to calculate the 33.8 billion present value estimate (as of Dec 31, 2024). I know you have not yet published his Appendix C, but I have reviewed it and he is clearly double discounting which is why his figure is so low. His inflation estimate of 3.86% is way too high and he does not seem to realize that inflation is already reflected in the project’s discount rate and in the 3.60% 10-year Canada bond yield he quotes. In short, the 33.8 billion figure, though an estimate, already incorporates both expected inflation and time value of money.

If you Google “Does a project's discount rate consider time value of money”, its AI overview will replay something similar to: “Yes, a project's discount rate explicitly considers the time value of money, as its core function is to calculate the present value of future cash flows.”

If you Google “does time value of money consider inflation” it will replay something like “Yes, inflation is a key factor considered within the time value of money (TVM) framework”.

There is nothing magic about Google here, it is giving textbook type answers. Mr. Wilson is getting this entirely wrong with his double discounting. If he gets something this basic so very wrong, I cannot put any faith in his other opinions.

Luke O'Brien, CFA Charterholder

I will start by saying the Ed Hollett's facial features, from photos and on TV sometimes, reminds me of the USA genius Ben Franklin. I think his face in on one of the America money bills, maybe the 1 dollar note. Franklin did the initial research in lightning, was world famous for this and invented the lighting rod to protect buildings, and more famous than Elon Musk today, when he went to France to persuade them to join the Revolutionary War against Britain.

On understanding the value of money, the other Americans politicians, then considered traitors by Britain, were all worried by all the money they were borrowing from France to fund Washington''s Army and the war in general. Franklin told them not to worry about that, explaining that "we'll pay it back in inflated dollars".

This inflation estimation in this MOU and today's value of this huge pile of money, supposed coming our way, is a very significant factor in this scam being put to the NL people. This is to to be expected from Quebec, they are very clever on these matters, but shameless promoted by the Liberal Government, Furey (who then skeedaggled away) and Nlfd Hydro, and Jennifer Williams ( whether she understands that issue like Franklin and Wilson and Hollett does.

Certainly the general public has no idea of the cleverness of this scam, when lumped with several projects into one, being a masterful art of deception.

I, an electrical engineer who worked with Nfld Hydro in high voltage power systems, had but one course in economics, far from an expert like Wilson or Dave Vardy, and some others. But like many who lived through the 1980s, when inflation hit about 20 %, we know the impacts on mortgage costs, and loss of value to the common worker on fixed wages, based on high inflation rates, and an average value over 50 years or more.

Indeed, how to bring this complex analysis to a level that the average person can understand, is not easy, to identify the truth of this. In my opinion, it is a world class con job. I feel confident is is world class, by the genius of the HQ negotiators, and our NL, (Newfie) spineless, self serving, soulless con artists.Just another SAD SAD SITUATION, as to our future, if this is not terminated.