Every Government of Newfoundland and Labrador since 2003 has left the place in worse financial shape than when it took office.

Every.

Single.

One.

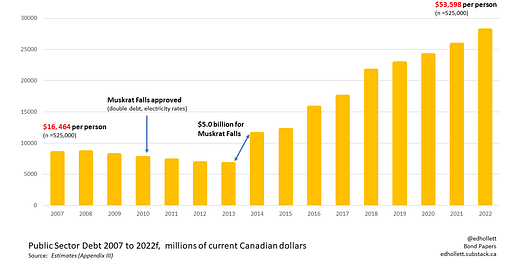

You can see it clearly in the chart above. It shows the public debt, as presented in the Estimates, one of the key budget documents released in Newfoundland and Labrador each year. The Estimates are compiled us…

Keep reading with a 7-day free trial

Subscribe to Bond Papers to keep reading this post and get 7 days of free access to the full post archives.