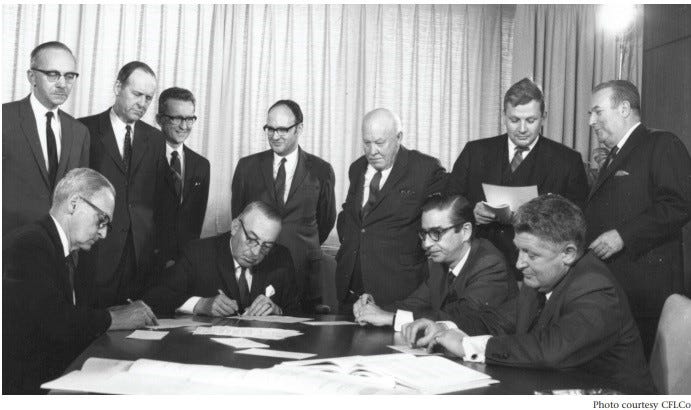

It's the same deal as 1969: Hydro-Quebec

Once again HQ tells Newfs more about NL business than their own government

On Monday, the same day that Andrew Furey rose in the House of Assembly during debate on his supposedly historic, transformational deal with Hydro-Quebec, a column by Francis Vailles in la presse gave the truth, straight from Hydro-Quebec:

"It's the same deal as in 1969 at the end of the day," said Dave Rhéaume, Hydro-Québec's senior vice-president and the man who co-led the negotiations with Newfoundland and Labrador alongside Hydro-Quebec chief executive Michael Sabia.

“Dave Rhéaume is categorical,” Vailles wrote. “In today's dollars, all the payments at cost price made by Hydro-Québec over 50 years, even indexed at 2%, will give the same overall sum as if Hydro- Quebec had chosen to make constant fixed payments as in 1969.”

Vailles explained the basic elements of the deal, including all the new generation. “To benefit from such an advantage, “Vailles noted, “[Hydro-Quebec] agreed to assume virtually all the risks of cost overruns on the projects, as in 1969. It also financed almost all of the projects, even the down payment that Newfoundland had to pay to be the majority shareholder in the joint venture [at Gull Island] with Hydro-Québec.”

Rheaume gave a different version of the overall project costs per kilowatt hour - 11 cents - than Furey and his team have given and a radically different version than anyone has seen in Newfoundland and Labrador of the Churchill Falls part of the new deal, indicating a rise to an effective price of seven cents a kilowatt hour at the back end of the deal.

“Over the entire period,” Vailles summarized, “before and after 2041 (2025-2075), the average cost of energy from this old plant for Hydro-Quebec comes to four cents per kilowatt hour (in today's dollars), once [Hydro-Quebec’s] share of the profits is deducted.”

“One of [Hydro-Quebec’s] hopes is that Newfoundland will not be able to take all of the 1990 MW it has set aside, which [Hydro-Quebec] could then buy back at cost, essentially,” Vailles wrote. This is actually something Newfoundland and Labrador Hydro chief executive Jennifer Williams told the House of Assembly this week, without letting on that the purchase price would be at cost, not some price that reflects the value of the electricity in the marketplace.

There are more details not explained to the locals in Newfoundland and Labrador by the government and its energy company. The price for electricity from Churchill Falls will not be indexed for a two percent annual increase, although electricity from the new plants will be. The price index for Churchill Falls will be based “90% on the price of Hydro-Quebec’s supplies in Quebec – including the heritage block – and 10% on the price of the electricity market in the American Northeast.” The total value of the electricity over 51 years is capped in the agreement at $33.8 billion, reinforcing Hydro-Quebec optimism about price, your humble e-scribbler would add.

“Under the agreement,” Vailles explains in a footnote, “[Hydro-Quebec] could notably buy back at cost the 360 MW from new electricity projects that its partner would not use.” The price could be lower if the electricity is not a long-term sale. “[Hydro-Quebec] could also buy back the unused energy from the old plant at the same price as the rest of the energy from the old plant.”

Stay ahead of the curve.